You wouldn’t be at loss though. There are huge investment opportunities offering ways to make money in the stock market for the period 2015-2016. The huge question however is that should you retain the mainstream stocks and continues in the field hoping for a flat increase in the stock prices or should you consider other opportunities that have the potential to influence the market trends? You can certainly consider other options if you want to derive profits out of your stock investments.

Investment in precious metals and oil

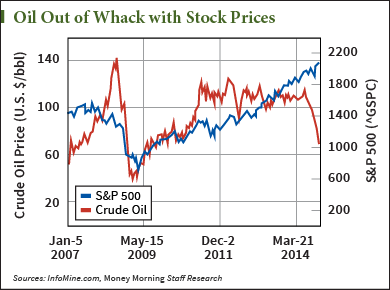

During the earlier phase of 2015, two industries demonstrated a change in the market potential as long as investment in stocks was concerned. The sectors were of precious metals and oil. There is immense popularity in the stocks of these two sectors. Investment in oil and precious metals sector is a great way for an average investor to start within the stock market. The only thing is that timing must be right to initiate the investment. You need to keep a keen eye on the way markets unfurl. There has been a decline in the precious metals and oil stocks. The prices have been steeply falling although records have been set in early 2015. If there is a slight change in the trend, then investments in these sectors can prove out to be one of the best opportunities for 2015-2016.

If a little bit of creativity is applied to the entire thought process in the stock market investment opportunities, one may witness a slowdown in the growth of economy and a steep rise in the interest rates. These could greatly impact the corporate earnings. However, there has been a steady rise in the corporate earnings in the past 6 years. So there is a need to consider the impact of the rise in the interest rates in a significant manner. If this happened, the giant market indexes such as S&P 500, NASDAQ and Dow would tumble owing to volatility. If this becomes true then the investors would have to look elsewhere to invest their money in the stock market. Would you be able to bet in a market where the interest rates would be steeply rising? The answer is yes. This can be done by purchasing exchange traded fund [ETFs] in the brokerage account. One can bet against the market growth with ETFs.

A lot of investors lose money with fluctuations in the market. However, they don’t really understand the market dynamics. It is vital to remember that markets are subjected to change before making any investments. The best opportunities often come to light with a change in the trend. The past six years have demonstrated this. The interest rates have miraculously remained this low. Never has the stock market gone up flat for six years.

The big investors have sensed the peculiarity demonstrated by the stock market in recent years as they have studied the dynamics of the market and reaped great benefits out of the investments. They have studied the entire market looking for the best opportunities for 2015-2016.

It isn’t tough to derive money by investing in the stock market. However, this isn’t possible when the market is tumbling. You need to be prepared beforehand because as winds of change blow anything is possible. It is best to study the market first and consider the investment opportunities. For the year 2015-2016, precious metals and oil have proved out to be tremendous investment avenues. You can look for more options by considering the stock market dynamics.