Day trading is now pressured by mixed data coming from China. C. Surpan, a principal for BO and Scarborough, has noticed how quickly the sentiment of the market turns for the Wall Street Journal.

Wall Street opened partially mixed Wednesday amid conflicting Chinese economic data as well as disappointing results in sales being reported by Macy’s.

Macy’s had reported unsatisfactory quarterly sales data too soon, blaming a strong USD that pushed off tourists from shopping. The company also says it will not form a REI trust for the time being but could redevelop some of their properties with joint investments or deals, as Reuters reports. Macy’s equity is being punished in the market, as their share price had declined to $40.10 on Wednesday from its previous closing level reaching $47.02.

Mixed data are sent from China by trade marketers, stating that the growth in industrial-production had dropped to 5.6 percent from last year; however, there was an encouraging 11% growth in retail sales, as reported by Reuters. The news had addressed prospects for U.S. interest rates to hike but left room for the E.C.B.to send more stimulus.

The dollar dropped in the currency markets, with the euro increasing slightly. The euro is now trading at $1.0738, while the dollar dropped against the yen, setting 123.05 yen to dollar. ECB President M. Draghi says that the B.E.O.F. market regulation cross-border is needed in order to ensure the integrity of market.

Lynch, CHGE for WF Investment Institute, sees a positive side to the fact that the lower growth target was accepted calmly.

Chinese government goes forward and expects to continue pressing with reforms, which include market liberalization as well as improving corporate governance.

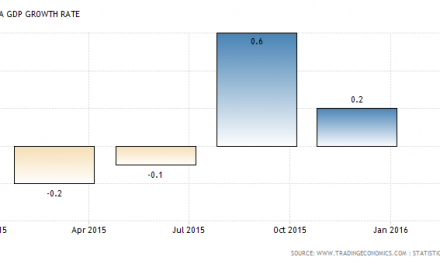

In September, The Shanghai stock market posted its biggest fall in in a long time when it announced a depreciation of more than 2.7%. The free-fall of the stock market caught every off-guard , and the Shanghai market was not the only one that suffered this fate, most stock markets in emerging countries such as Russia, Brazil , and South Africa also suffered the same fate. With the United States economy bouncing back from a long recession and the strengthening of the US dollar, it is believed that super power economies such as China will still find it difficult to cope for a very long time to come.

Though , the Shanghai stock market has since bounced back in the month of November but results are not good enough to restore the confidence of investors, who seem to be worried that the growth in the US economy will further hurt the Chinese economy’s growth in the future. The drop in commodity prices has also lead to a raid decline in not only the stocks but also the Chinese currency.