There are numerous Forex brokers around us these days. As the popularity of this investment vehicle, new “Forex brokers” have been growing up on a on a daily basis. Anyone new to Forex can get frustrating to decide with which broker to open an account which is exceptionally valuable in helping beginner traders. To make that decide, one of the factors on which he must base his/her decision is the broker’s methodology and trading systems.

Brokerage various trading styles and systems should match the opinion of the broker in order to make trader feel confident in trading. Appropriate researches into the broker’s past experience should indicate the direction and course he has followed in the past and the majority likely to take in the future. As far the trading classification go, there are four basic varieties which include scalping, swing trading, position trading and day trading.

Scalping trading is one of the types of day trading, except it differs as the duration of time span that trades are detained. Scalping trades are exceptionally quick; regularly hold for a few seconds, or on most a few minutes. Day trading trades held from a small time span to a couple of hours and it is more suitable for those traders who enjoy starting and finishing a trade in the same day.

Swing trades are typically held for numerous days and this is most suitable for people that have the tolerance power to wait, though one time they have come into a trade they want it to done cost-effective and fairly quickly. The Swing traders are not good for people that feel concerned holding a trade while they were not in contact with their computer. And position trades are trades that held the maximum time and include trades that end for number of years.

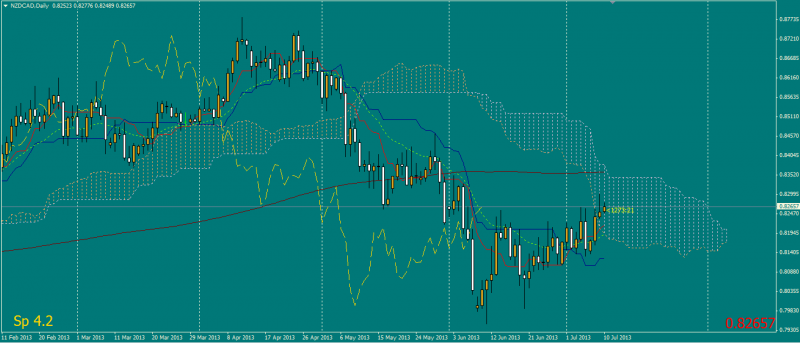

Moving ahead from trading systems, one system which have recuperated its reputation of late is Ichimoku Kinko Hyo. Ichimoku Kinko Hyo is one of an essentially trading system designed by a Japanese paper man named “Goichi Hosada in the mid-20th Century”. The marketing chart was launch to the public in 1968 later than years of testing by Hosada and his students. The concept is not much popular as proved complex for Westerners to grab the gears which were designed in Japanese, which result that, it was used mostly in Japan and throughout the Asian markets.

All the expressions, listed in the Japanese language that certainly confuse yet the experienced trader at first but with some guidance and practice it can establish as a very flourishing Forex indicator.