Before reacting to the changes in the market, it is best to take some time and analyze the market dynamics. It is normal to experience market volatilities. Witnessing a drop by 5% isn’t rare. The fall in the index isn’t rare and doesn’t last long. It is vital to adhere to the strategy planned with the advisor. If tweaking in the strategy is necessary then this should be consulted with the advisor. Being governed by emotions sometimes prompts an investor to indulge in risky stocks. It is better to take out time to think rather than act immediately.

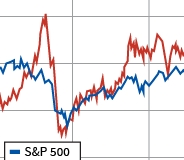

Volatility makes many investors question the strategies adopted by them. Novice investors are greatly impacted by the volatility. Volatility in the marketplace is inevitable. It is extremely difficult to time the market over a short span of time. The best thing to do is to focus on a long term goal and ignore the short lived fluctuations.

Heavy trading and wide fluctuations in the prices are the characteristics of volatile markets. These arise due to imbalance in the trading orders. Company news, economy releases, initial public offering, unexpected earnings and recommendations from a popular analyst can greatly result in volatility in the market. There isn’t any particular reason that contributes to volatility in the stock market. However, it persists and is unavoidable. Here are a few things to consider in the fluctuating market.

Stay invested

The best way to deal with market fluctuations is to remain invested and not pay heed to the short term fluctuations. This may be hard at times but can greatly help. Long term investing can promise profits. However, one needs to study the market dynamics and the consistent performance demonstrated by a company before holding stocks of the company for a long term. Volatility period is in fact an ideal time to invest in a company if you believe that the company would put up a great performance consistently.

Here are a few things to be aware of:

Delays: Volatile markets are linked to high trading volumes that can result in delays. This can delay the execution. Investors need to question the firms and ask them to explain the methodologies followed while handling executions in a volatile market. Quick executions are expected in the world of online trading. This is not the case in real though.

Website chaos

Many a times there is a difficulty in trade execution owing to the limitations in the capacity of the system. If you are trading online then you may have issues accessing your trade account owing to high traffic. This is the sole reason why firms offer alternatives such as faxing the order and telephone trades.

Inaccurate quotes

Many times, there are discrepancies in the quote received and the trade executed. In a volatile environment, real time quotes don’t tally with the current happenings in the market. The prices at which the shares are available are also subjected to frequent fluctuations.

When the market is volatile, the order chosen is quite crucial as it is always executed. However, in fast markets, the price may be different substantially from the placed orders. Limit order can prove out to be a bit more expensive than the market orders. However, the best thing about limit orders is that they have the purchase price fixed. The downside is that a guarantee in execution isn’t offered in a volatile market.

Conclusion

the potential risks associated with the volatility phase needs to be acknowledged. Choosing to remain invested can be a wonderful idea if you have full faith in your investment strategy. If you decide to carry out trade during the volatility period, then you need to be aware of the way the market condition would affect your trading.