In order to understand foreign exchange, it is important to first and foremost understand that it is a trade. And the subject of trade happens to be foreign currency.

What is foreign currency?

Foreign currency is simply currency that is not local – currency that belongs to another country other than the country the user is in. For example, anyone residing in the US can name the US dollar (US$) as the local currency while naming the Japanese Yen (¥) as one of many foreign currencies. When people want to import goods, they have to acquire the foreign currency from the country that is selling the goods. And the only way to acquire foreign currency is by buying it like any other good.

That is the reason the value of the local currency is gauged against the value of the foreign currency in question and the currency exchange carried out in a balanced way. That exchange of currencies is basically what is referred to as Foreign Exchange; or Forex, in short – trading involving different currencies.

Where is foreign currency stored?

After the foreign exchange has taken place, the foreign currency can either be deposited in the customer’s foreign currency account, or used to pay foreign bills immediately. Customers paying for imports usually use banks and all they do is provide the local currency equivalent of the foreign invoice to their local bank which then settles the bills on behalf of the customer.

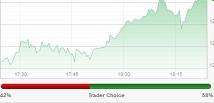

Other traders engage in forex trading as a means to earn profits. Those are the cases where a forex trading broker comes in handy. In forex trading, currencies are paired so that it is easy to compare one currency against another in terms of strength or weakness. If, for instance, on a Monday morning, the pair of currencies A:B is in the ratio 1:1.5, it means that a customer needs to have one and a half units of currency B to be able to acquire one unit of currency A. In this case, Currency A is stronger than Currency B. And if the figure representing Currency B is descending as the day wears on and has reached 1.35 by Monday afternoon, it means that Currency A is getting weaker.

In practical cases where, for example, a resident of Europe wants to trade with the Euro against the USD, the pairing is done in terms of EUR/USD. In this case, the Euro is taken to be the base currency. The base currency here (EUR) is said to be getting stronger when the figure of the USD rises and getting weaker when the figure of USD falls. Practically speaking, when the exchange rate of EUR/USD changes from 1.25 to 1.245, it means that the US dollar has gained value against the Euro. Alternatively, possibly something has happened to make the Euro weaken against the US dollar.

Advantages of Engaging In Forex Trading

- For one, forex trading allows the investor to trade at a global level without necessarily travelling abroad.

- Trading in forex takes place on a 24hr basis and only halts on weekends

- It also enables an investor to make profits by trading; buying foreign currency when it is weak and selling it when it is strong.

- It enables importers to pay for their imports without suffering losses from fluctuating value of import bills. Here, as long as the importer has the foreign currency in a bank account, the amount of money spent to pay the foreign bills is equal to the amount anticipated at the time of importing the goods.

Another thing worth noting is that the law of supply and demand affects the forex market the same way it affects the commodity market. If too many people are demanding to buy a given foreign currency to pay for imports at a certain time, the local currency weakens against that particular foreign currency. That means the people in the exporting country can make hay at that time because their currency is significantly stronger.